Los Angeles Apartment Occupancy Rates Driving Rent Increases

Not that it isn’t obvious enough already, but take a look at the article that I found today in Curb LA regarding Los Angeles metro apartment rent increases versus vacancy rates.

Not that it isn’t obvious enough already, but take a look at the article that I found today in Curb LA regarding Los Angeles metro apartment rent increases versus vacancy rates.

This is a big boom to Los Angeles commercial real estate agents and landlords and not so good for tenants.

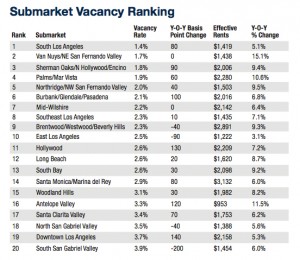

Citywide, rents are up an average of 7.8% over last year to an average of $1,873 per month. Northeast San Fernando Valley prices are up 15.1%. Los Angeles single family homes prices have increased 5.2% and incomes 2.9%.

Take a look at vacancy rates. That explains everything. When you see vacancy rates down to the 1% and 2% range, the sky’s the limit on rent increases.

In spite of all the new multiunit residential construction, and there’s a bunch, we need more and denser. Los Angeles has over 15,000 units under construction right now with half of all new supply is coming online downtown. Notice that downtown has the second highest vacancy rates and one of the slower rates of rent growth so there’s obviously a connection there. We’re going to need to out build the population increases to keep a lid on rents.

Great thing is that all of the new mixed use high rises that are going downtown, and along the Wilshire corridor, will include street level net leased retail and that’s where I come in. Los Angeles and Santa Monica commercial realtors are happy folks right now.

http://la.curbed.com/archives/2015/11/los_angeles_rents_2015.php

As always, if anyone is looking for triple net retail or restaurant space to buy or lease, feel free to contact me, Scott Harris at 310-473-4789.

Follow

Follow