Monthly Commercial Real Estate Property Closed Sales Results

CoStar’s monthly National Composite Index of Commercial Real Estate increased for the seventh consecutive month in November 2011. I know its January 19, 2012, but it takes them around 45 days to get the numbers out to us.

CoStar’s monthly National Composite Index of Commercial Real Estate increased for the seventh consecutive month in November 2011. I know its January 19, 2012, but it takes them around 45 days to get the numbers out to us.

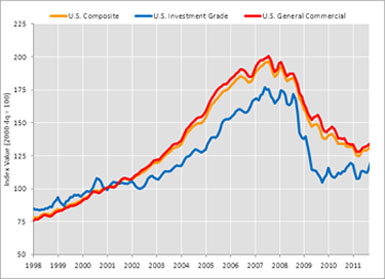

Leading the price recovery again has been investment grade property. There’s nothing new there as I’ve been writing about this for months. Plus, anyone who has been with me for the last several months while we’re shopping for just that ‘perfect’ single tenant, triple net or absolute net long corporate leased retail has discovered this first hand.

The investments grade index achieved a 2.2% increase in November versus the previous month and 6.4% over the same period last year. Growth has been strong since March 2011.

The General Commercial Index rose 1.4% in November from same period last year. That’s the seventh consecutive monthly increase, reversing a 32 month decline.

Distress sales decreased from 53% of all sales in March 2011 o 22% in November 2011. We’ve also had the second consecutive monthly year over year increase of 2.2% in the composite index from the same period last year. Needless to say, this is a good sign of a broad base recovery in the commercial real estate market and easing of downward pressure on pricing. .

The recovery is not as strong yet as previous recoveries yet with the composite index 31.8% below the August 2007 peak of the previous boom. I do think we’re off to a modest, steady recovery that’s sustainable. Please remember that an overheated market only gets us to the next bust quicker. It’s just the way free markets work. However, in every boom / bust cycle, the next peak is higher than the previous peak.

Sales volume is still down primarily because we have so little inventory of just that ‘perfect’ property. So again, developers, sellers and owners, if you have new triple net or absolute net single tenant retail coming out of the ground or newer already tenanted property, I’d be real interested. In spite of being substantially below the all time sales volume peak, transaction volume is about average.

What we’re seeing is a broad based recovery. Barring something cataclysmic happening internationally, we’re on our way to good six or seven years before the next downturn. Absolutely, it will happen again.

CoStar – News – Article – Commercial Real Estate Price Index Rises for Seventh Consecutive Month

Follow

Follow