1031 Exchange Uplegs – Fee Simple to Fee Simple Ground Lease

Continuing what I was writing about a couple days ago regarding the possible 1031 upleg chosen if a buyer in an exchange in the 45 day identification period can’t find a suitable fee simple property that meets the buyers’ other criteria such as national credit, absolute net, S&P BBB or better, etc. It’s not a 1031 exchange issue to move from a fee simple to fee simple ground lease as it can be going to a leasehold interest or will be with a short term leasehold interest.

When you buy a ground lease you’re leasing the land to the tenant who builds or has built the improvements knowing that if they leave, the improvements revert back to the landowner. Fee simple ground leases generally trade at lower caps because they offer the utmost in security.

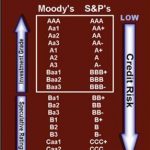

Most credit tenants are not going to vacate a building that they spent hundreds of thousands on construction. It’s still real important to choose the correct credit tenant. The generally rule is S&P BBB (or the equivalent Moody’s), or above is investment grade. I’ll publish a list within a couple of days of major retailers and credit ratings.

The big downside to fee simple ground lease is that you can only take depreciation on improvements, not land, so if the tenant owns the building, then they get to take the depreciation write off. Of course, if you sell, you don’t get stuck with the recapture. A leasehold interest can be expensed, but any improvements the tenant makes revert back to the landowner at termination of the leasehold.

Regarding a land acquisition, typically, the ground rent of a property is far lower than the rent achievable if one was to own both land and improvements as fee simple, so should a tenant default or vacate on a ground lease, the landlord / property owner should be able to achieve a much higher rental figure for both land and building given the basis at which they purchased just the land.

Follow

Follow