Net Leased Retail Become Hotter Due to Low Yields on Alternative Investments

Single tenant, net leased retail has continued to gain strength as an asset class. With an economy barely growing, one could wonder why is triple net and absolute net retail as strong as it is? Given what else is available as a safe investment, it’s no wonder net leased retail is doing well. Ten year government bonds are yielding around 1.5 percent while a triple or absolute net leased, single tenant retail property offers a return of 5 to 8.5 percent with at least a ten year lease with rent increases. Net leased retail properties rarely require much in the way of landlord management responsibility with most requiring no landlord responsibility at all.

When it comes to national credit tenants, rated BBB or above by Standard and Poor’s, in the top 50 metros, demand has been on par or exceeded that of multifamily assets making the two segments the strongest in the industry. There’s little risk with this asset class provided that the location is good and the building is well maintained as there will always be tenants willing to lease even if the existing occupant leaves.

The challenge for investors is the dearth of supply and the competitiveness of the bidding. This is not a product class where if you find a newer absolute net, single tenant, BBB S&P rated or above retail property, that you can sit and ponder the acquisition for a few weeks. The asset will be in contract within days. If the asset has been on the market for a while, I generally pass with the assumption that something is wrong and other prospective buyers have invested the time to discover the problem. It’s better to move on. It is hugely competitive though, and we typically have the property tied up by the second or third day it’s on market.

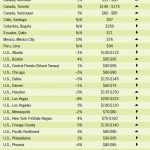

In the last twelve months, transactions for net leased retail assets totaled just under $7 billion with the average cap rate of 6.8% and an average price of $254 per sq ft. The number of available retail assets rose 18 percent from the first quarter of 2012 to the second to 3,508 properties on market.

REITS are buying entire portfolios versus trying to accumulate assets one by one. On just September 6th Realty Income Corp., an Escondido, Calif.–based REIT specializing in net lease properties, bought American Realty Capital Trust, which owns 501 triple or absolute net leased properties, for approximately $2.95 billion. Then Lexington Realty Trust, a New York City based REIT, acquired a portfolio of net lease office and industrial properties from Inland American for $480 million.

As Nicholas S. Schorsch, chairman and CEO of American Realty Capital, puts it: “You’ve got an asset class that’s very durable, with no capital expenditures, long-term leases, corporate credit tenants and no operating expenses. So it makes it particularly appetizing as an investment profile. But more importantly, you’ve got interest rates that are historically low right now, so it’s a very good dynamic—you can get very strong returns, while maintaining honest leverage.”

The mega-transactions taking place indicate that institutional investors’ voracious appetites for quality net lease assets have met with a dearth of supply and skyrocketing valuations on one-off deals, says Randy Blankstein, president of the Boulder Group, a Northbrook, Ill.–based real estate services firm focused on the net lease sector.

Follow

Follow